Passive income is a dream for many solopreneurs. It means earning money with little effort.

This blog explores ways to create passive income for those working alone. Solopreneurs often juggle multiple tasks, from marketing to bookkeeping. Finding extra income streams can ease their workload. Passive income offers financial security and freedom. It allows solopreneurs to focus on their passions.

It’s not just about making money; it’s about creating a sustainable business. With the right strategies, solopreneurs can enjoy more leisure time. They can invest in personal growth. Discover how you can increase your earnings without increasing your workload. Dive into ideas that suit your lifestyle and ambitions. Passive income might be the key to your success.

Introduction To Passive Income

Exploring passive income ideas empowers solopreneurs to earn money while focusing on their passions. Discover methods like affiliate marketing, online courses, and digital products. These strategies require effort initially but can generate income with minimal ongoing work.

Thinking about making money while you sleep? That’s the dream, right? Passive income can make that possible. As a solopreneur, creating streams of passive income can be a game-changer for your business and lifestyle. This concept isn’t just about financial freedom; it’s about having more control over your time. Let’s dive into what passive income means and how it benefits solopreneurs like you.What Is Passive Income?

Passive income is money earned with minimal effort. It’s not about trading hours for dollars but rather setting up systems that work for you over time. Think about royalties from a book, rental income, or earnings from an online course. These streams require an initial investment of time or money but continue to generate revenue with little ongoing work. It’s not always about getting rich quickly, but building a steady financial foundation.Benefits For Solopreneurs

Being a solopreneur can be demanding, with you wearing all the hats. Passive income can ease this burden. It provides financial stability, reducing reliance on a single income stream. This can be especially valuable during slow periods in your main business. Additionally, passive income can free up your time. Imagine having more hours to spend on creative projects or personal interests. Wouldn’t that be amazing? By integrating passive income streams, you can balance your life and work more effectively, leading to increased satisfaction and less burnout. As you consider these options, think about your skills and passions. Which areas can you capitalize on? Identifying these can lead you to a passive income idea that’s both profitable and fulfilling.

Credit: oddnoodle.com

Digital Products

Digital products offer solopreneurs an accessible way to earn passive income. They require minimal overhead and can reach a global audience. Creating and selling digital products can transform your expertise into a steady revenue stream. Explore how crafting e-books and launching online courses can boost your income potential.

Creating E-books

Writing e-books allows you to share your knowledge with others. Choose a topic you understand well. Break it down into digestible parts. Use simple language to explain complex ideas. Keep your sentences short. This improves readability for non-native speakers.

Design an attractive cover. A good design attracts more buyers. Use tools like Canva for easy design. Format the content professionally. Platforms like Amazon Kindle Direct Publishing make it easy to publish. Promote your e-book through social media. Engage with your audience and encourage feedback.

Launching Online Courses

Online courses let you teach skills in-depth. Break down your subject into modules. Use video and text to explain ideas. Keep lessons concise and focused. Consider using platforms like Udemy or Teachable. They offer user-friendly interfaces.

Engage with learners through quizzes and discussions. Provide certificates to add value. Market your course via email newsletters. Share snippets of your content to attract students. Update your course regularly. This keeps it relevant and engaging.

Affiliate Marketing

Affiliate marketing can be a game-changer for solopreneurs seeking passive income streams. It’s the process of earning commissions by promoting other people’s products or services. Imagine earning money while you sleep, simply by sharing links and recommendations. Sounds enticing, right? But, to maximize your earnings, you need to choose the right products and build a loyal audience. Let’s dive deeper into these crucial steps.

Choosing The Right Products

Your success in affiliate marketing hinges on selecting products that resonate with your audience. Choose products that you genuinely believe in and can confidently recommend. Your authenticity will shine through, making your recommendations more effective.

Consider products that align with your niche or expertise. Are you a tech enthusiast? Promote the latest gadgets or software. Passionate about wellness? Look at health supplements or fitness programs. This alignment will make your promotions feel natural and appealing.

Research is key. Check reviews, test the products if possible, and ensure they offer fair commissions. Your credibility is on the line, so pick wisely. A personal story: I once promoted a product I hadn’t fully vetted. My audience noticed the mismatch, and it affected trust. Lesson learned – always prioritize quality and relevance.

Building An Audience

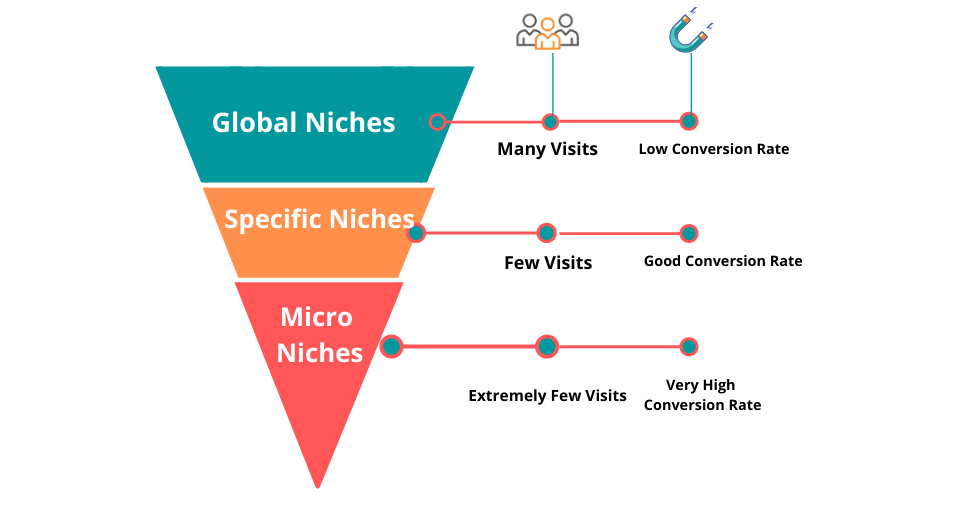

Building a dedicated audience is crucial for affiliate marketing success. Without an audience, your links won’t be clicked, and commissions won’t be earned. Start by defining your target audience and understanding their needs and preferences.

Engage with your audience through content that adds value. Write blog posts, create videos, or host webinars that address their pain points. Encourage interaction and feedback. This will help you refine your approach and build a community around your brand.

Consistency is key. Regularly update your content and stay active on social media. Share insights, tips, and updates related to your niche. As your audience grows, they’ll begin to trust your recommendations more, potentially leading to higher conversion rates.

What strategies have you tried to build an audience? Have you considered collaborating with influencers or guest posting on reputable blogs? These tactics can expand your reach and introduce your brand to new followers.

Affiliate marketing offers solopreneurs a viable path to passive income. By carefully selecting products and nurturing an audience, you can create a sustainable income stream. Ready to start your affiliate marketing journey?

Credit: it-it.facebook.com

Dropshipping

Dropshipping offers solopreneurs a simple way to earn passive income. By selling products online without holding inventory, you can focus on marketing and customer service. This business model allows you to partner with suppliers who handle storage and shipping, making it easier to manage your business.

Dropshipping has become a popular passive income stream for solopreneurs, thanks to its low startup costs and minimal inventory risk. It’s a retail model where you sell products without holding any stock yourself. Instead, you partner with suppliers who handle storage and shipping. This allows you to focus on marketing and customer service, making it a convenient choice for those looking to build a business with flexibility. But how do you get started with setting up your dropshipping store and managing suppliers effectively?Setting Up A Store

Creating your dropshipping store is an exciting first step. Begin by selecting a platform like Shopify or WooCommerce. These platforms offer user-friendly interfaces and numerous customization options. Choose a niche that interests you and has a demand in the market. This focus helps you attract the right audience and makes marketing easier. Design your store to be visually appealing and easy to navigate. Use high-quality images and clear product descriptions. This can increase trust and encourage purchases.Managing Suppliers

Finding reliable suppliers is crucial for your dropshipping success. Websites like AliExpress or SaleHoo can connect you with thousands of suppliers. Do your research and read reviews to ensure they have good reputations. Establish clear communication with your suppliers. Discuss shipping times, return policies, and product quality. This ensures a smooth operation and keeps your customers happy. Regularly evaluate your suppliers’ performance. Check delivery times and product quality to maintain high standards. If a supplier isn’t meeting expectations, be ready to find alternatives. Think about how you can grow your relationships with suppliers. Could negotiating better terms or exclusive products give you an edge? Addressing these questions can boost your business. In dropshipping, the store setup and supplier management are key. How will you optimize these processes to create a successful passive income stream?Investing In Real Estate

Real estate offers solopreneurs a reliable way to earn passive income. Renting out properties can provide steady cash flow. It’s an investment that grows over time. Consider diversifying your portfolio with different types of properties.

Investing in real estate can be a powerful way for solopreneurs to generate passive income. With the right approach, you can diversify your income streams and build wealth over time. Real estate offers various avenues to explore, each with its own set of benefits and challenges.Rental Properties

Owning rental properties is a tried-and-true method for earning passive income. By purchasing a property and renting it out, you can create a steady stream of monthly income. Imagine owning a small apartment building and having tenants pay rent each month. Your initial investment can grow over time as property values increase. However, being a landlord comes with responsibilities like maintenance and tenant management. Consider hiring a property management company if you want a hands-off approach. Rental properties require upfront capital, but they can offer significant returns. Have you ever thought about the potential of investing in a duplex or triplex? These properties can maximize your rental income while minimizing costs.Real Estate Crowdfunding

Real estate crowdfunding is an innovative way to invest in property without the hassle of direct ownership. Through online platforms, you can pool your money with other investors to finance real estate projects. This approach allows you to start with a smaller investment and still access lucrative markets. Imagine being part of a group that funds a commercial building in a booming area. You get a share of the profits without dealing with tenants or repairs. It’s a way to diversify your portfolio and reduce risk, as you’re not tied to a single property. Crowdfunding provides transparency, allowing you to review project details and expected returns. Are you ready to explore this modern investment strategy? It opens doors to real estate opportunities that were once limited to high-net-worth individuals. Investing in real estate can be a rewarding venture for solopreneurs seeking passive income. Whether you choose rental properties or crowdfunding, each option offers unique benefits. Consider your financial goals and risk tolerance to decide which path suits you best.

Credit: businessingmag.com

Stock Market Investments

Stock market investments offer a reliable path to passive income. They involve buying shares that represent ownership in companies. These investments can grow wealth over time, making them attractive for solopreneurs.

Dividend Stocks

Dividend stocks pay regular cash returns to shareholders. Companies distribute a portion of their earnings as dividends. These payments provide a steady income stream. Selecting strong companies with consistent dividends is crucial. Look for firms with a track record of dividend growth. This indicates stability and potential for future payouts. Diversifying your portfolio reduces risk and enhances returns.

Index Funds

Index funds pool money to invest in a broad market index. They offer exposure to a range of stocks, reducing risk. Low management fees make them cost-effective. They track the performance of a specific stock index. This passive approach suits solopreneurs seeking stable growth. Over time, index funds can yield significant returns. A long-term investment strategy is advisable for maximum benefits.

Automated Online Businesses

Automated online businesses offer solopreneurs a chance to earn passive income. They need less time and effort once set up. This makes them ideal for those managing tasks alone. These businesses run smoothly with digital tools and systems. Two popular ideas are creating membership sites and running subscription services. Both provide steady income while requiring minimal upkeep.

Creating Membership Sites

Membership sites offer exclusive content to paying members. They can be courses, tips, or a community forum. Set up a website with a secure membership area. Use tools like WordPress plugins for easy management. Members pay monthly or yearly fees for access. This ensures a regular income stream. Update content periodically to keep members engaged. It attracts new members and retains existing ones. The site runs itself once established.

Running Subscription Services

Subscription services deliver products or services regularly. They could be digital products or curated boxes. Use platforms like Shopify to set up your store. Subscribers pay a recurring fee for regular deliveries. This model ensures a predictable income flow. Automate order processing and shipping. This saves time and reduces workload. Consider offering different tiers for various budget levels. It appeals to a wider audience.

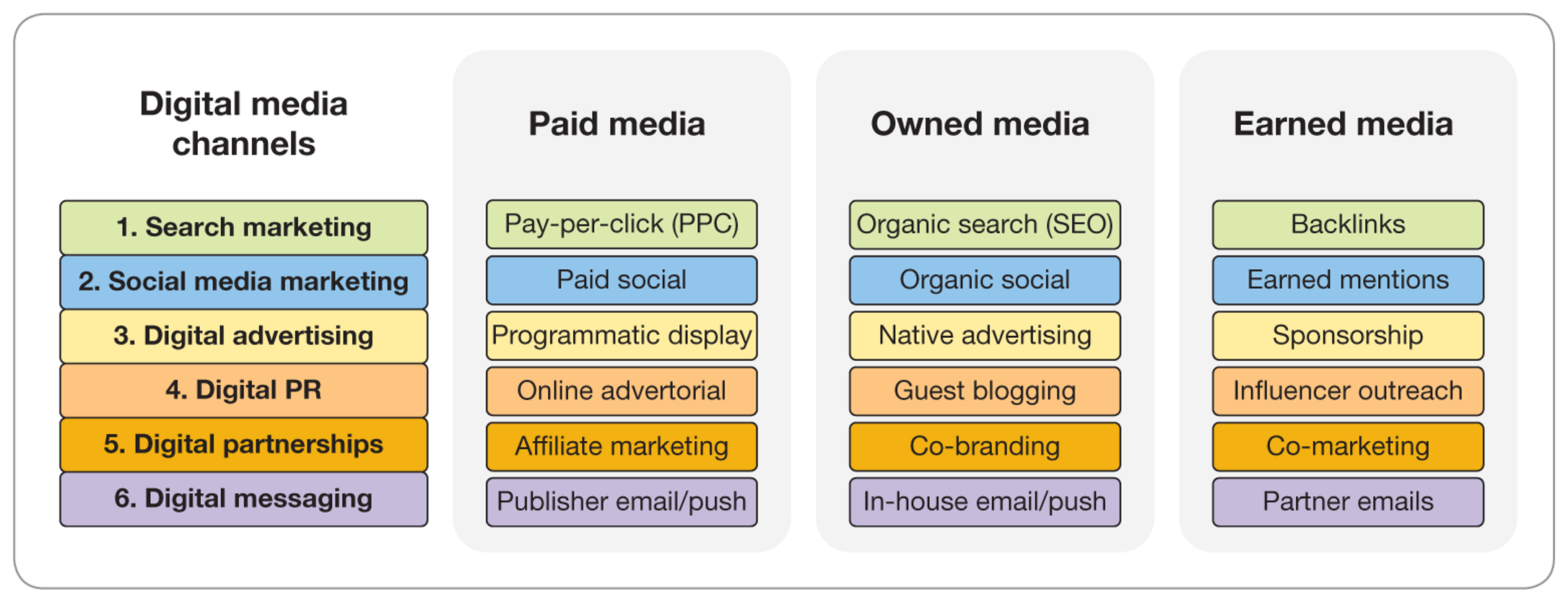

Leveraging Social Media

Social media offers solopreneurs a world of opportunities for passive income. With billions of users, platforms like YouTube and Instagram can help you earn money while you sleep. This section explores how solopreneurs can leverage these platforms effectively. Learn to monetize your creativity and content with ease.

Monetizing Youtube Channel

Creating a YouTube channel can be a smart way to earn. Start by finding your niche. Focus on what you love. Upload regular videos to engage viewers. Once you reach 1,000 subscribers and 4,000 watch hours, apply for the YouTube Partner Program. This lets you earn from ads. Use affiliate marketing in your videos. Promote products you trust. Earn commissions for sales through your links.

Another way to earn is through sponsorships. Brands pay you to talk about their products. Ensure the products fit your audience’s interests. You can also sell your own products or courses. Mention them in your videos. Encourage viewers to check them out.

Earning Through Instagram

Instagram is a visual platform. Perfect for promoting products and services. Start by building your following. Post high-quality, engaging content regularly. Use stories, reels, and posts to connect with your audience. As your following grows, explore brand partnerships. Companies pay for sponsored posts.

Affiliate marketing works here too. Share links in your bio or stories. Earn a commission for each sale. Consider selling your own products or services. Use Instagram Shopping to tag products in your posts. Make it easy for followers to buy. Engage with your audience to build trust. Respond to comments and messages promptly.

Conclusion And Next Steps

Passive income ideas empower solopreneurs to enhance financial stability and freedom. Explore diverse strategies to earn money effortlessly. Begin implementing these ideas to gradually build a sustainable income stream.

As you venture into the world of passive income as a solopreneur, it’s crucial to focus on what comes next. The journey doesn’t end with setting up your passive income stream. There’s always room for growth and improvement. To ensure your success, you need clear goals, a commitment to continuous learning, and a proactive approach to expand your earnings.Setting Goals

Setting goals is your roadmap to success. Start by identifying what you want to achieve with your passive income streams. Do you want to supplement your current income or eventually replace it altogether? Once you have clarity, break down these objectives into smaller, manageable tasks. For example, if your goal is to earn $500 a month through affiliate marketing, calculate the number of sales required and the strategies to achieve them. Regularly review and adjust your goals as needed. Celebrate small wins to keep your motivation high.Continuous Learning

Learning never stops, especially in the ever-evolving digital landscape. Stay informed about the latest trends in passive income opportunities. Dedicate time each week to read articles, attend webinars, or take online courses. When I started blogging for passive income, I found a treasure trove of insights from a course on SEO. It transformed my approach and grew my audience significantly. Ask yourself: What new skills can boost your passive income potential? Embrace changes and adapt your strategies accordingly. Technology and consumer behavior evolve, and staying ahead ensures your efforts remain effective. As a solopreneur, you’re in charge of your own learning curve. You’ve explored the possibilities of passive income, set your goals, and committed to learning. Now, take action. Start small, but start today. Create a plan that aligns with your goals and begin implementing it. Track your progress and make adjustments based on real-world results. Engage with others in the solopreneur community. Share experiences and learn from their journeys. What challenges did they face, and how did they overcome them? Remember, passive income streams can grow over time with dedication and strategic planning. Keep pushing forward, and soon you’ll see the fruits of your effort. Your future self will thank you for the steps you take today.Frequently Asked Questions

How To Make $1000 A Month Passively?

Invest in dividend stocks, create an online course, or rent out property. Start a blog or YouTube channel. Use affiliate marketing, sell digital products, or invest in peer-to-peer lending. Choose strategies that fit your skills and interests. Diversify income streams for consistent passive earnings.

How To Passively Make $2000 A Month?

Invest in dividend stocks or REITs for regular income. Rent out a spare room on Airbnb. Create a blog or YouTube channel with affiliate marketing. Use peer-to-peer lending platforms. Consider selling digital products or courses online. Diversify your income streams for consistent results.

What Is The Highest Paying Passive Income?

Real estate investments often generate the highest passive income. Rental properties provide consistent cash flow. Dividend stocks and REITs also offer substantial passive income. Online businesses, like selling digital products, can yield high returns. Choose the right option based on your risk tolerance and expertise.

How To Make $100,000 A Year In Passive Income?

Invest in dividend stocks, real estate, or peer-to-peer lending platforms. Create digital products or online courses. Build a blog or YouTube channel for ad revenue. Use affiliate marketing and monetize social media. Diversify income streams and reinvest earnings to maintain and grow passive income over time.

Conclusion

Passive income can boost solopreneurs’ financial stability. These ideas need patience and commitment. Choose what aligns with your skills and interests. Start small, and watch your income grow steadily. Explore different options for diverse revenue streams. Keep learning to improve your strategies.

Connect with others for insights and support. Stay motivated, even when progress seems slow. Success in passive income requires persistence. Remember, every small step counts towards your goals. Embrace the journey and enjoy the financial freedom it brings.